- Definition and Types of Energy

- Myths And Misconceptions About Energy

- The Relationship Between Energy and Environment

- Climate Change and Carbon Footprint

- Greenhouse Gas Effect

- The Role of Human-Induced Greenhouse Gases and Energy Consumption

- Energy Efficiency and Sustainability

- Renewable Energy Sources and Future Perspectives (video)

- Play and Learn

- Solar Energy Conversions

- Solar Energy Worldwide

- Solar Energy in Partner Countries

- Positive and Negative Impacts

- Technologies for Harnessing Solar Energy

- Solar thermal energy technologies and applications

- Electricity Generation Methods

- Passive Heating and Cooling of Residences with the Sun

- Concentrator solar power (CSP) systems and electricity generation

- Systems and Applications That Generate Electricity directly from solar rays

- Photovoltaic Cells and Panels

- Domestic PV Systems

- Off-Grid PV Systems

- Hybrid Connected Systems

- Materials Used in PV Cells

- Play and Learn

Biofuel Technology in Partner Countries

Biofuel Technology in Türkiye

Türkiye has a significant potential in renewable energy production with its rich biomass resources. Biomass obtained from agriculture, forestry and animal wastes is used for energy production. According to the Biomass Energy Potential Atlas (BEPA) prepared by the Ministry of Energy and Natural Resources, the total economic energy equivalent of collectible waste and residues in Türkiye has been calculated as approximately 3.9 million tons of oil equivalent (MTEP). As of the end of 2021, Türkiye's installed capacity based on biomass exceeded 2,000 megawatts, and biomass power plants accounted for 2.3% of total electricity generation. Bioethanol production in Türkiye has been on the agenda in various periods since the 1930s. As of 2016, there are three bioethanol production facilities in Konya, Bursa and Adana.

There are 13 companies that have received licenses from the Energy Market Regulatory Authority in Türkiye for biodiesel production. However, the number of companies engaged in regular and periodic production is less than 10. There are legal regulations that encourage the use of bioethanol and biodiesel in Türkiye. Bioethanol produced from domestic agricultural products can be used as a fuel additive and is exempt from certain taxes. Similarly, when biodiesel is produced from domestic agricultural products, it can be added to diesel and provide tax advantages. Bioethanol, gasoline; Biodiesel, on the other hand, is used by mixing it with diesel in certain proportions. It is obligatory to use biofuels produced from domestic products in certain proportions. However, due to the high production costs in the biodiesel sector, the production sector experiences a pause from time to time.

Biofuel Technology in Portugal

Portugal has shown a strong commitment to the energy transition, with biofuels playing a key role in this process. In line with the European Union's goals, the country has invested in biofuel production and usage to reduce greenhouse gas emissions and diversify energy sources. Biodiesel remains the most widely used biofuel, primarily produced from vegetable oils such as rapeseed and soy, as well as an increasing amount of used cooking oil (UCO). Encouraging UCO use supports the circular economy and reduces dependence on imported raw materials, while biodiesel blending in diesel is essential for meeting renewable energy targets in transport. Bioethanol, produced from sugar-rich biomass like beet and corn, plays a smaller role but has growth potential through research and new technologies. Additionally, biogas production from organic waste—such as agricultural residues, urban waste, and wastewater treatment plant sludge—has gained importance, contributing to electricity and heat generation and holding potential for injection into the natural gas grid. Portugal also participates in European initiatives for developing biojet fuel, a promising alternative for sustainable aviation.

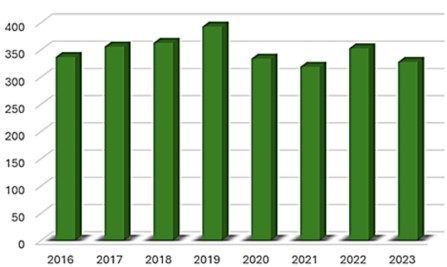

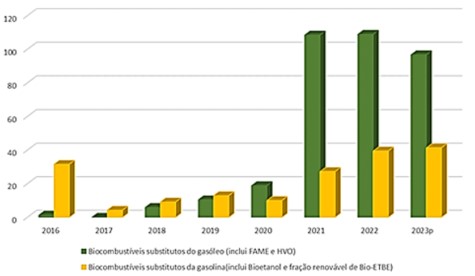

Portugal's biofuel policies align with EU directives, particularly the National Energy and Climate Plan 2030 (PNEC 2030), which sets ambitious targets for biofuel incorporation in transport. The government has actively promoted UCO collection and processing and recently approved the Action Plan for Biomethane 2024-2040 (PAB). This strategic plan focuses on creating and consolidating a biomethane market to reduce GHG emissions and support economic decarbonization by leveraging local resources and decreasing reliance on imported natural gas. Biodiesel (FAME) production remains the main focus of Portugal’s biofuel industry, with a significant increase in UCO usage. Data from DGEG indicates a continuous rise in national biofuel production, while biofuel imports have also grown, reflecting increasing demand and the need to supplement domestic production.The following figure shows the evolution of total biofuel production (FAME and HVO) between 2016 and 2023:

From 2021 onwards, there was a significant increase in biofuel imports compared to previous years. Data from 2016 to 2023 show this growing trend, although the 2023 values are still provisional.

Portugal's biofuel sector faces several challenges, including reducing dependence on imported raw materials, minimizing the environmental impact of energy crop production, and developing infrastructure for biogas and biojet fuel. However, there are also significant opportunities, such as expanding the use of advanced biofuels derived from waste and non-food biomass, investing in biogas and green hydrogen, and fostering collaboration between universities, research centers, and industry. The recently approved Action Plan for Biomethane 2024-2040 (PAB) further creates new opportunities by promoting biomethane infrastructure, encouraging innovative business models, and strengthening the circular economy.

The National Biofuels Strategy (ENB) provides key guidelines for the sector, emphasizing sustainability and innovation. Research and development efforts have explored alternative raw materials, such as algae and forest residues, to enhance biofuel production. Additionally, increasing environmental awareness among consumers has led to greater demand for biofuels, further driving the sector’s growth.

Biofuel Technology in Greece

Greece has potential for the production of biofuels, driven by its abundant agricultural and forestry resources. Biomass derived from crop residues, forestry by-products, and organic waste is used for biofuel production, making Greece well-positioned to enhance its renewable energy capacity. According to studies and reports from the Ministry of Environment and Energy, the country’s biomass resources, including olive oil mill waste and agricultural residues, hold great promise for biofuel production. As of 2023, Greece’s installed bioenergy capacity, including biofuels, exceeds 800 megawatts, contributing to a notable portion of the country’s renewable energy generation. The primary biofuels produced in Greece are bioethanol and biodiesel, both of which are produced from domestic agricultural products such as wheat, corn, and rapeseed.

Bioethanol production has been an important sector in Greece since the early 2000s. The country has several bioethanol plants, mainly located in agricultural regions, where bioethanol is produced from cereals and other crops. These bioethanol plants play an important role in meeting Greece's energy needs and contribute to reducing greenhouse gas emissions. Greece has also made significant strides in the biodiesel sector, with the production of biodiesel from agricultural waste, particularly from olive oil mill residues, a common by-product in Greece's large olive oil industry. Several biodiesel production facilities are operational in Greece, producing biodiesel for domestic consumption and export. These biofuels are often used as additives in transportation fuels, reducing the carbon footprint of the transportation sector.

The Greek government has implemented several policies and incentives to encourage the use of biofuels, including subsidies for biofuel production and tax exemptions for biofuels derived from domestic agricultural products. Bioethanol and biodiesel blends are mandated to be used in the country’s transportation sector, with specific percentages set for their inclusion in gasoline and diesel fuels. Despite these advancements, the biofuel sector in Greece faces challenges, particularly in terms of high production costs and the reliance on government subsidies. In addition, competition with other renewable energy sources, such as solar and wind energy, has at times slowed the pace of biofuel production growth.

Looking ahead, Greece is focused on increasing its biofuel production capacity as part of its commitment to the European Union’s renewable energy targets. The country aims to further develop its biofuel sector, leveraging its agricultural output to produce cleaner, sustainable fuels while reducing dependence on fossil fuels. Biofuels are expected to remain a key component of Greece’s renewable energy strategy, contributing to the country’s energy security and environmental goals.

Biofuel Technology in North Macedonia

North Macedonia has been exploring renewable energy sources, including biofuels, to diversify its energy mix and enhance sustainability. As of 2020, the country reported no production of biofuels and bioliquids, indicating a nascent stage in this sector.

Despite the limited development in biofuels, North Macedonia has made strides in bioenergy, particularly through biogas projects. A notable example is the 2-MW biogas plant in Lozovo, which commenced operations in December 2022. Equipped with two MWM TCG 2020 V12 gas engines, this facility supplies approximately 4,000 households with electrical energy, marking a significant step toward sustainable energy production.

The country's energy supply heavily relies on oil and coal, accounting for 45% and 32% of the total energy supply in 2022, respectively. This dependency underscores the need for diversification through renewable sources. While biofuel production remains underdeveloped, the existing biomass resources, such as wood from fruit trees and other plant residues, present opportunities for future energy production. In 2023, the primary production of biomass from these sources was reported at 1.924 thousand tons of oil equivalent (TOE).

To further promote bioenergy, companies like SERVODAY are introducing innovative biomass solutions in North Macedonia. These include portable pellet production units and advanced biomass boiler feeding systems, aiming to enhance efficiency and fuel flexibility in the energy and manufacturing sectors.

While biofuel technology is still emerging in North Macedonia, the development of biogas plants and the utilization of biomass resources indicate a growing commitment to renewable energy. Continued investment and technological innovation are essential to fully harness the potential of biofuels and bioenergy in the country's energy landscape.